Section 179 lets businesses deduct the full purchase price of qualifying equipment and software in the year it’s placed in service instead of depreciating over time. It applies to purchases or financed leases, as long as the asset is used >50% for business and placed in service by December 31.

What is Section 179?

Section 179 is a U.S. tax incentive designed to encourage investment by letting you deduct 100% of eligible equipment and off-the-shelf software in the first year it’s used for your business. It improves cash flow, accelerates ROI, and works whether you buy or finance the equipment.

Who Qualifies?

Most small and mid-sized U.S. businesses—including sole proprietors, LLCs, and freelancers—qualify if they: purchase/finance eligible equipment, place it in service by year-end, use it >50% for business, and stay under the spending cap.

What Equipment Qualifies?

Typical Section 179 property includes:

Manufacturing machinery & tools

Material handling (forklifts, conveyors)

Medical devices

Office tech (computers, printers, copiers)

Off-the-shelf software

Certain building improvements (HVAC, roofing, security)

Heavy business vehicles over 6,000 lbs GVWR

Not eligible: real estate, gifts/inherited property, and most passenger vehicles.

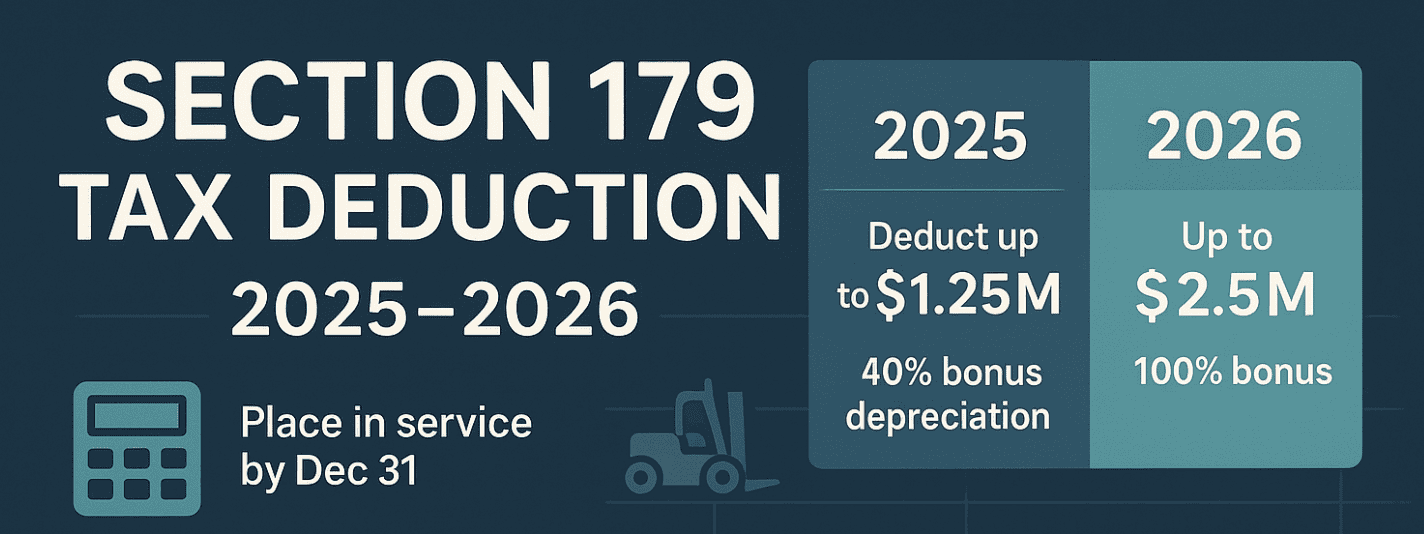

2025 Limits (with example)

Deduction limit:$1,250,000

Phase-out begins:$3,130,000 (full phase-out: $4,380,000)

Bonus depreciation:40% after Section 179

Example (2025):

Purchase price $1,300,000 → Section 179 $1,250,000; remaining basis $50,000 → 40% bonus = $20,000; total first-year deduction $1,270,000. At a 35% tax rate, estimated tax savings $444,500; effective net cost $855,500.

2026 Changes at a Glance

Max deduction:$2,500,000

Phase-out starts:$4,000,000 (full phase-out: $6,500,000)

Bonus depreciation:100%

Example (2026): $5,000,000 total purchase → Section 179 (adjusted) + 100% bonus = $5,000,000 first-year deduction. (See the Quick Comparison table on page 3 of the guide.)

How to claim Section 179 (5 steps)

- Purchase or finance qualifying equipment and place it in service by Dec 31.

- Confirm >50% business use.

- Calculate: apply Section 179 first, then bonus depreciation.

- File IRS Form 4562 with your tax return.

- Keep records (invoices, financing docs, proof of use).

Financing + Section 179: Why it’s powerful

Because Section 179 applies to financed equipment too, many businesses deduct the full amount in year one while paying for the asset over time.

Common Pitfalls to Avoid

- Waiting until the last minute to place the equipment order - Make sure your equipment can be delivered and installed before Year-End.

- Missing documentation (e.g., delivery, installation, usage logs).

- Assuming passenger vehicles qualify like heavy vehicles.

Reach out to Five West Financial to learn more about structuring the right financing program to maximize your Section 179 Tax Incentives.

Phone: (855) 957-9438

Email: info@fivewestfinancial.com