Key Takeaways:

Key Takeaways:

The SBA introduced the 7(a) Working Capital Pilot (WCP) Program in 2024.

It provides up to $5 million in working capital through revolving or non-revolving lines of credit.

Businesses must have at least 12 months of operational history to qualify.

Learn whether this SBA loan is the right choice for your business and explore alternative options.

What is the SBA 7(a) Working Capital Pilot Program?

What is the SBA 7(a) Working Capital Pilot Program?

The 7(a) Working Capital Pilot (WCP) Program is a specialized SBA initiative designed to provide small businesses with flexible working capital. Whether you need to cover seasonal fluctuations, finance large orders, or invest in growth, this program offers loan amounts up to $5 million to support your business.

The SBA guarantees up to $3.75 million per loan, with higher guarantee percentages for smaller loans—up to 85% for loans of $150,000 or less.

Key Features of the SBA 7(a) Working Capital Loan

Key Features of the SBA 7(a) Working Capital Loan

Maximum Loan Amount: $5 million

Repayment Period: Up to 5 years

Interest Rates: Based on loan amount:

$50,000 or less: Base rate +6.5%

$50,001 – $250,000: Base rate +6.0%

$250,001 – $350,000: Base rate +4.5%

$350,001 and greater: Base rate +3.0%

Acceptable Base Rates: Prime rate, SOFR + 3%, SBA’s Optional Peg Rate

Two Types of SBA 7(a) Working Capital Lines of Credit

Two Types of SBA 7(a) Working Capital Lines of Credit

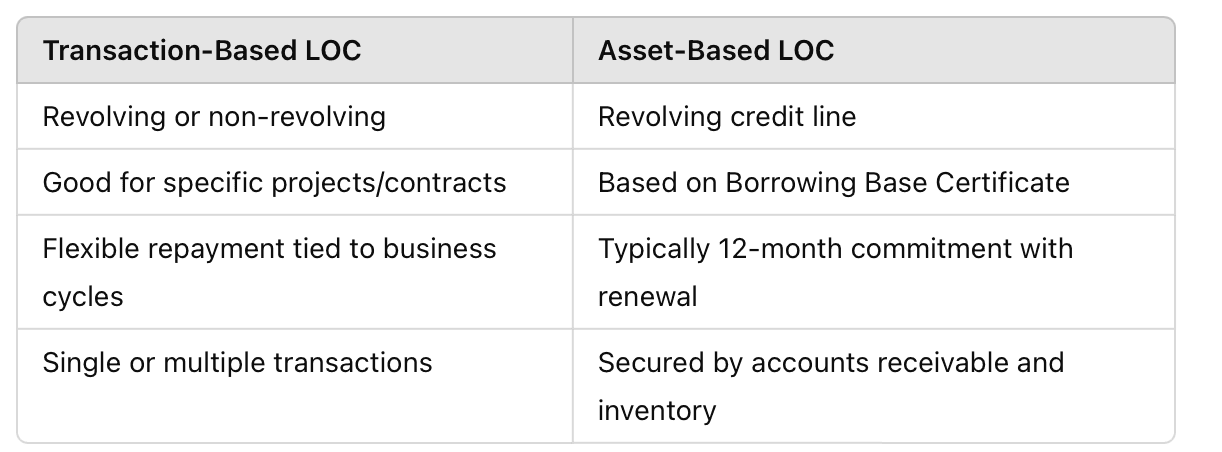

Transaction-Based Line of Credit

Best for: Businesses financing specific projects or transactions.

Structure: Can be revolving or non-revolving.

Use Cases: Ideal for manufacturers needing inventory financing or contractors working on government projects.

Asset-Based Line of Credit

Best for: Businesses with stable accounts receivable and inventory.

Structure: Revolving credit line, secured by A/R and inventory.

Terms: Based on a monthly Borrowing Base Certificate, typically includes a 12-month commitment with renewal options.

Benefits of the SBA 7(a) WCP for Small Business Owners

Benefits of the SBA 7(a) WCP for Small Business Owners

Access funds as needed—you only pay interest on borrowed amounts.

Flexible structure—works for both early-stage businesses and established companies needing working capital.

Supports business growth—can be used to transition from SBA Express loans to larger financing solutions or expand internationally.

Eligibility Requirements

Eligibility Requirements

To qualify for the SBA 7(a) Working Capital Program, businesses must meet the following criteria:

Business History: At least 12 months of operational history.

Financial Management: Applicants must provide:

Financial statements

Accounts receivable and payable aging reports

Inventory reports

Size Standards: Business must meet SBA-defined small business size requirements.

Location: Must be a for-profit business located in the United States.

Industry Restrictions: Prohibited industries include gambling, pyramid sales, and speculative investments.

Creditworthiness: No strict credit score requirement, but lenders will assess business and owner credit history.

Alternatives to the SBA 7(a) Working Capital Program

Alternatives to the SBA 7(a) Working Capital Program

If the WCP isn’t the right fit, consider:

SBA Express Loan – For smaller funding needs with a faster approval process.

Invoice Factoring – Convert unpaid invoices into cash.

Business Line of Credit – Alternative revolving credit with fewer restrictions.

Microloans – Ideal for startups needing $50,000 or less.

Is the SBA 7(a) WCP Right for Your Business?

Is the SBA 7(a) WCP Right for Your Business?

If your business needs short-term working capital but struggles with traditional financing, the SBA 7(a) WCP might be a great fit. However, if you need fast funding, you might want to explore alternative lending solutions.

At Five West Financial, we specialize in helping businesses navigate SBA loans and find the best financing solutions tailored to their growth. Contact us today to explore your options!