Turn Capital Needs into Strategic Growth

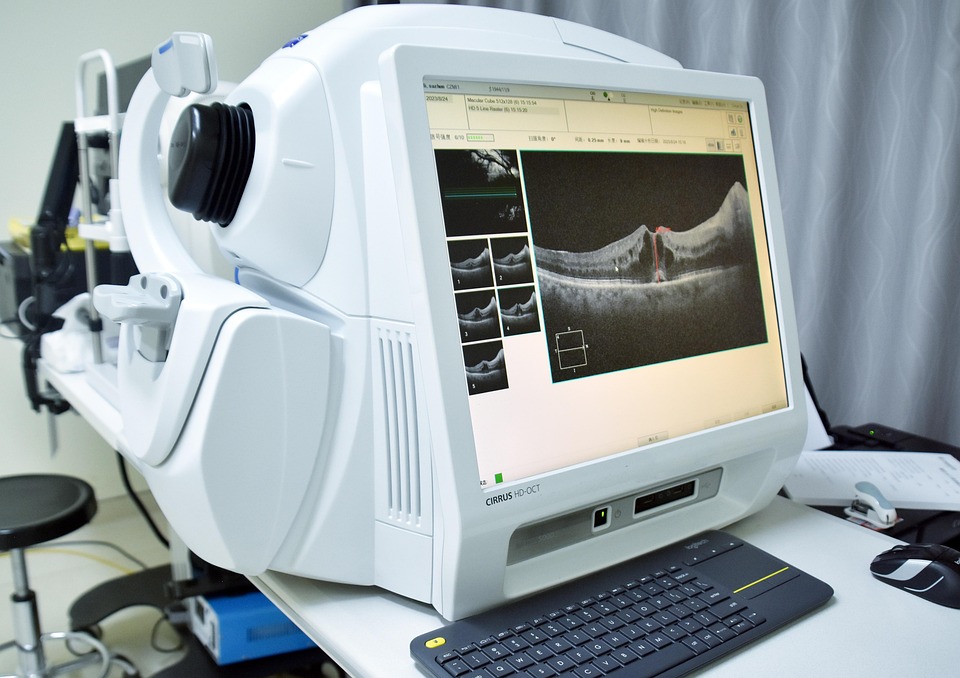

Five West Financial helps small to medium size businesses access flexible, equipment-backed financing solutions - allowing equipment vendors and manufactures to service all customer credit types through a single point of contact. We specialize in structuring capital for operators and vendors across focused industries in Healthcare and Commercial where we maintain deep expertise of industry demands. Whether it's a startup securing their first piece of equipment or an established company expanding operations, we help move deals from idea to funding with precision.